What Are Life Insurance Policies Worth . life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or. Your budget and individual situation dictate if you need. we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. life insurance offers a cash value component that allows you to build wealth. Otherwise, you may not need it. life insurance can be worth it if your death would place a financial burden on someone else. we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life and protective. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your.

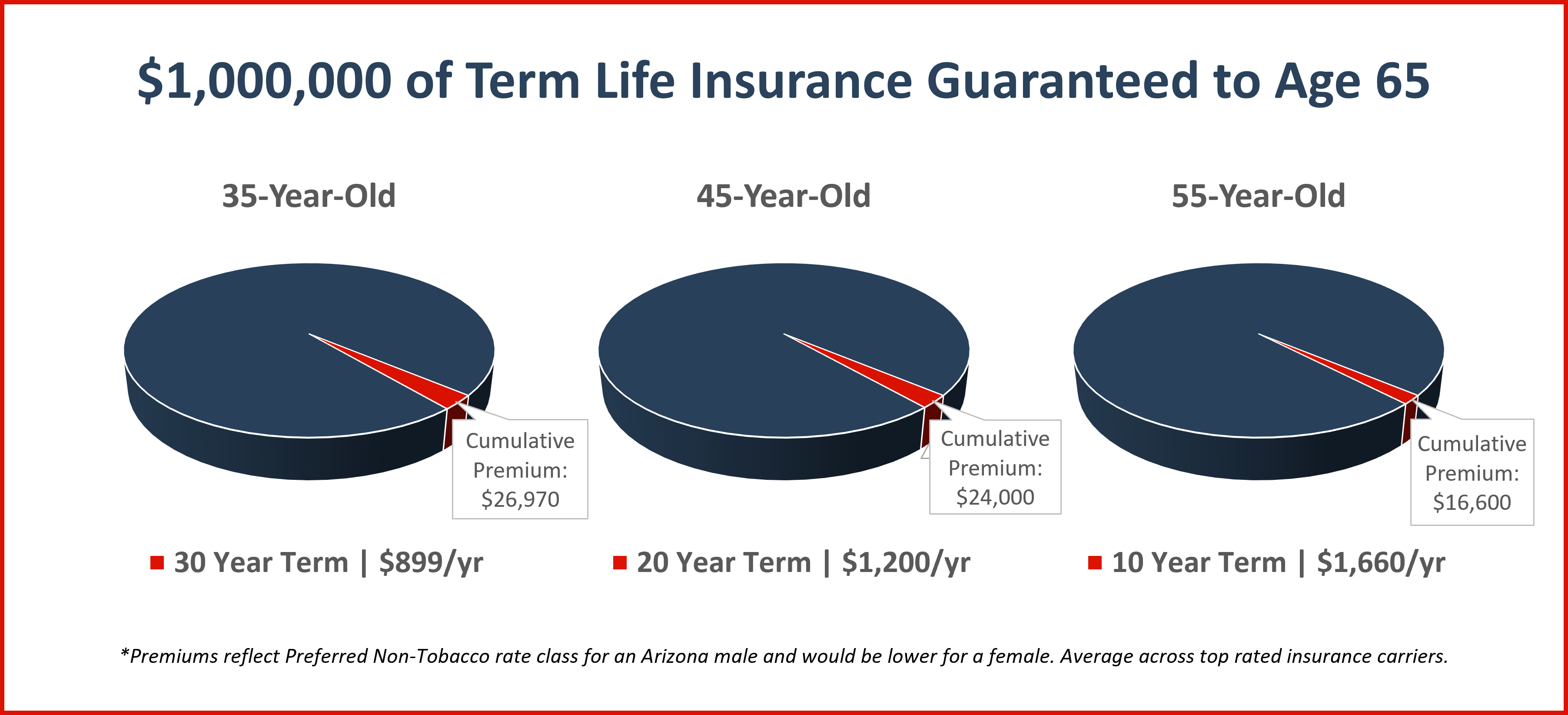

from riskresource.com

Your budget and individual situation dictate if you need. life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or. life insurance offers a cash value component that allows you to build wealth. Otherwise, you may not need it. we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance can be worth it if your death would place a financial burden on someone else. we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life and protective.

Insuring Your Economic Value with Term Life Insurance Risk Resource

What Are Life Insurance Policies Worth we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life and protective. Otherwise, you may not need it. we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. Your budget and individual situation dictate if you need. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or. life insurance can be worth it if your death would place a financial burden on someone else. life insurance offers a cash value component that allows you to build wealth.

From wealthfit.com

How Does Life Insurance Work? WealthFit What Are Life Insurance Policies Worth we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life and protective. Your budget and individual situation dictate if you need. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance can be worth it if your death. What Are Life Insurance Policies Worth.

From www.slideteam.net

Cash Value Table Of Whole Life Insurance PPT Example What Are Life Insurance Policies Worth Your budget and individual situation dictate if you need. Otherwise, you may not need it. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance can be worth it if your death would place a financial burden on someone else. life insurance is a contract between. What Are Life Insurance Policies Worth.

From www.investopedia.com

Types of Life Insurance Policies What Are Life Insurance Policies Worth we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. Otherwise, you may not need it. life insurance can be worth it if your death would place a financial burden on someone else. life insurance is a contract between an insurance company and a policy owner in which. What Are Life Insurance Policies Worth.

From foldertips.com

What is a Single Premium Whole Life Insurance Policy & How It Works What Are Life Insurance Policies Worth we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. life insurance offers a cash value component that allows you to build wealth. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance can be worth. What Are Life Insurance Policies Worth.

From www.topquotelifeinsurance.com

Understanding Whole Life Insurance Quotes & Illustrations Top Quote What Are Life Insurance Policies Worth if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance can be worth it if your death would place a financial burden on someone else. life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a. What Are Life Insurance Policies Worth.

From policybank.com

How Much is My Life Insurance Policy Worth? PolicyBank What Are Life Insurance Policies Worth if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. Otherwise, you may not need it. we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life and protective. Your budget and individual situation dictate if you need. life insurance can. What Are Life Insurance Policies Worth.

From insurancetypes11.blogspot.com

Insurance Types In India Many Types Of Insurance Are Available In The What Are Life Insurance Policies Worth life insurance can be worth it if your death would place a financial burden on someone else. we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. life insurance offers a cash value component that allows you to build wealth. if you’re thinking about buying a life. What Are Life Insurance Policies Worth.

From livewell.com

What Type Of Life Insurance Policy Generates Immediate Cash Value What Are Life Insurance Policies Worth life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or. life insurance offers a cash value component that allows you to build wealth. Your budget and individual situation dictate if you need. if you’re thinking about buying a life insurance. What Are Life Insurance Policies Worth.

From www.policygenius.com

Understanding Your Life Insurance Policy Policygenius What Are Life Insurance Policies Worth if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance offers a cash value component that allows you to build wealth. we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. we analyzed term life and. What Are Life Insurance Policies Worth.

From www.investopedia.com

Understanding Life Insurance Loans What Are Life Insurance Policies Worth Your budget and individual situation dictate if you need. life insurance offers a cash value component that allows you to build wealth. life insurance can be worth it if your death would place a financial burden on someone else. we explain whole life cash value charts found on policy illustrations to help you make an informed decision. What Are Life Insurance Policies Worth.

From www.policyadvisor.com

What Is Term Life Insurance And How Does It Work? PolicyAdvisor What Are Life Insurance Policies Worth life insurance offers a cash value component that allows you to build wealth. we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life and protective. life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money. What Are Life Insurance Policies Worth.

From fidelitylife.com

How much does life insurance cost? What Are Life Insurance Policies Worth Otherwise, you may not need it. Your budget and individual situation dictate if you need. we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. life insurance can be worth it if your death would place a financial burden on someone else. life insurance offers a cash value. What Are Life Insurance Policies Worth.

From www.investopedia.com

Life Insurance Strategies What Are Life Insurance Policies Worth life insurance can be worth it if your death would place a financial burden on someone else. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a. What Are Life Insurance Policies Worth.

From www.pinterest.com

The Difference Between Surrender Value And Cash Value of A Permanent What Are Life Insurance Policies Worth life insurance can be worth it if your death would place a financial burden on someone else. life insurance offers a cash value component that allows you to build wealth. Your budget and individual situation dictate if you need. we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life. What Are Life Insurance Policies Worth.

From www.ramseysolutions.com

What is Cash Value Life Insurance? Ramsey What Are Life Insurance Policies Worth Your budget and individual situation dictate if you need. we analyzed term life and cash value life insurance policies of 16 companies and found that pacific life and protective. life insurance offers a cash value component that allows you to build wealth. we explain whole life cash value charts found on policy illustrations to help you make. What Are Life Insurance Policies Worth.

From wrsinsurancesolutions.com

Types of Life Insurance Whole Life, Term, Cash Value Policies WRS What Are Life Insurance Policies Worth we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. if you’re thinking about buying a life insurance policy, evaluating your budget, the needs of your dependents, and your. Your budget and individual situation dictate if you need. we analyzed term life and cash value life insurance policies. What Are Life Insurance Policies Worth.

From www.americanlifefund.com

How Much Is My Life Insurance Policy Worth What Are Life Insurance Policies Worth life insurance can be worth it if your death would place a financial burden on someone else. Otherwise, you may not need it. Your budget and individual situation dictate if you need. life insurance offers a cash value component that allows you to build wealth. if you’re thinking about buying a life insurance policy, evaluating your budget,. What Are Life Insurance Policies Worth.

From www.sappscarpetcare.com

Whole Life Insurance Calculator Cash Value What Are Life Insurance Policies Worth we explain whole life cash value charts found on policy illustrations to help you make an informed decision on. life insurance can be worth it if your death would place a financial burden on someone else. Otherwise, you may not need it. we analyzed term life and cash value life insurance policies of 16 companies and found. What Are Life Insurance Policies Worth.